Volksbank Insights: Banking, Cards & More (Oberbayern)

Are you struggling to navigate the complexities of modern banking and financial services? It's imperative to unlock the full potential of your financial resources, and understanding the intricacies of banking options is the first step.

The modern financial landscape can be a daunting one, filled with jargon, complex products, and a constant stream of new technologies. For individuals and businesses alike, making informed decisions about banking and financial services is more critical than ever. This article delves into a comprehensive exploration of banking solutions, drawing upon the operational framework of institutions like Volksbanken Raiffeisenbanken, with a particular focus on the regional banking model exemplified by banks rooted in communities like Beuerberg and Eurasburg.

Let's consider a hypothetical scenario: You are a young professional eager to manage your finances effectively. You need a reliable banking solution that offers flexibility, security, and convenience. Or perhaps you are a business owner seeking financing options to expand your operations. You need a bank that understands your unique needs and can provide tailored solutions. In both cases, understanding the diverse range of services offered by modern banks is crucial.

- Uncovering The Rich Tapestry Of Laura Govans Heritage A Journey Into Identity And Culture

- Unveiling The Gogolak Legacy Discoveries And Insights Await

Online banking is a game-changer, offering unparalleled convenience and accessibility. Banks like Volksbanken Raiffeisenbanken emphasize the importance of securely unlocking your account for online banking. This feature allows you to manage your finances from anywhere, at any time. The advantages are numerous: checking balances, transferring funds, paying bills, and tracking transactions are all at your fingertips. Moreover, the VR Banking App provides a secure and user-friendly platform for accessing your accounts and utilizing features like the electronic mailbox, streamlining communication and document management.

Securing a fixed interest rate for future financing is a strategic move that can provide peace of mind and financial stability. Whether you are planning to purchase a home, invest in your business, or pursue other long-term goals, knowing that your interest rate is locked in can protect you from market fluctuations and unexpected rate hikes. Banks offer various financing options with fixed interest rates, allowing you to plan your budget with confidence.

Sometimes, a personal touch is essential. Banks understand the importance of providing accessible customer service and expert advice. Scheduling an appointment for your banking needs or a consultation with a financial advisor can be invaluable, especially when dealing with complex financial matters. This personalized approach ensures that you receive tailored solutions and expert guidance to help you achieve your financial goals.

- Unveiling The Origins Of Timthetatman Discover His Roots

- Treyvon Diggs Love Life Unveiling The Secrets And Exploring The Possibilities

Regional banks play a vital role in supporting local communities and economies. These banks are often deeply rooted in the areas they serve, providing financial services tailored to the specific needs of local residents and businesses. The Volksbanken Raiffeisenbanken model exemplifies this approach, with banks like the one in Beuerberg offering a range of services, including agricultural financing, construction loans, and market support. This localized approach fosters strong relationships and contributes to the overall economic health of the community.

Agrar, baustoffe und märkte—these are the cornerstones of many local economies, and banks play a crucial role in supporting these sectors. By providing financing and other financial services to farmers, construction companies, and market vendors, banks help to ensure the continued success and growth of these vital industries. This support can take many forms, from providing loans for equipment purchases to offering lines of credit for working capital.

Finding the right branch is essential for accessing the banking services you need. Banks provide easy access to branch information, including opening hours, contact details, and directions. Whether you prefer to conduct your banking in person or simply need to access an ATM, knowing the location and hours of your local branch is crucial. For example, the Eurasburg branch offers convenient access to a range of banking services for local residents and businesses.

With a history dating back to 1894, banks like Volksbanken Raiffeisenbanken have a long tradition of providing universal banking services. This means that they offer a wide range of financial products and services to meet the diverse needs of their customers. From checking and savings accounts to loans, investments, and insurance products, these banks provide a comprehensive suite of solutions to help you manage your finances effectively.

Banks like Volksbanken Raiffeisenbanken understand the importance of simplifying the banking experience. Their motto, "Wir machen den weg frei" (We clear the way), reflects their commitment to providing easy-to-use products and services that empower customers to achieve their financial goals. This commitment extends to providing clear and concise information, offering helpful customer support, and continuously innovating to meet the evolving needs of their customers.

Collaboration is key to success in the modern financial landscape. Banks work closely with specialists from the cooperative financial group Volksbanken Raiffeisenbanken to provide customers with access to a wide range of expertise and resources. This collaborative approach ensures that customers receive the best possible advice and support, whether they are seeking financing, investment advice, or insurance products.

Debit cards, such as the BasicCard, offer a convenient and secure way to manage your spending. These cards are particularly well-suited for young adults and security-conscious customers who want to avoid the risks of credit card debt. Debit cards allow you to spend only the money that is available in your account, helping you to stay within your budget and avoid overspending.

Membership in a credit union or cooperative bank can provide access to exclusive discounts and promotions. These benefits can range from discounts on travel and entertainment to special rates on loans and insurance products. By becoming a member, you can not only support your local community but also enjoy a range of valuable benefits.

Partner programs offer a variety of discounts and perks at participating businesses. These programs are designed to provide members with access to exclusive deals and savings on a wide range of products and services. With thousands of participating partners, you can save money on everything from dining and shopping to travel and entertainment.

In conclusion, navigating the world of banking and financial services requires a thorough understanding of the options available. By exploring the services offered by banks like Volksbanken Raiffeisenbanken, understanding the benefits of online banking, securing fixed interest rates, leveraging personal consultations, and supporting regional banks, you can empower yourself to make informed financial decisions and achieve your goals.

- Unveiling Skillibengs Age Discoveries And Insights Revealed

- Meet The Unsung Hero Behind Zach Edeys Success Unlocking The Fathers Influence

Webstream.eu RB Beuerberg Vidéo à la demande et livestreaming

Die Raiffeisenbank Beuerberg Eurasburg eG feiert 125 jähriges Bestehen

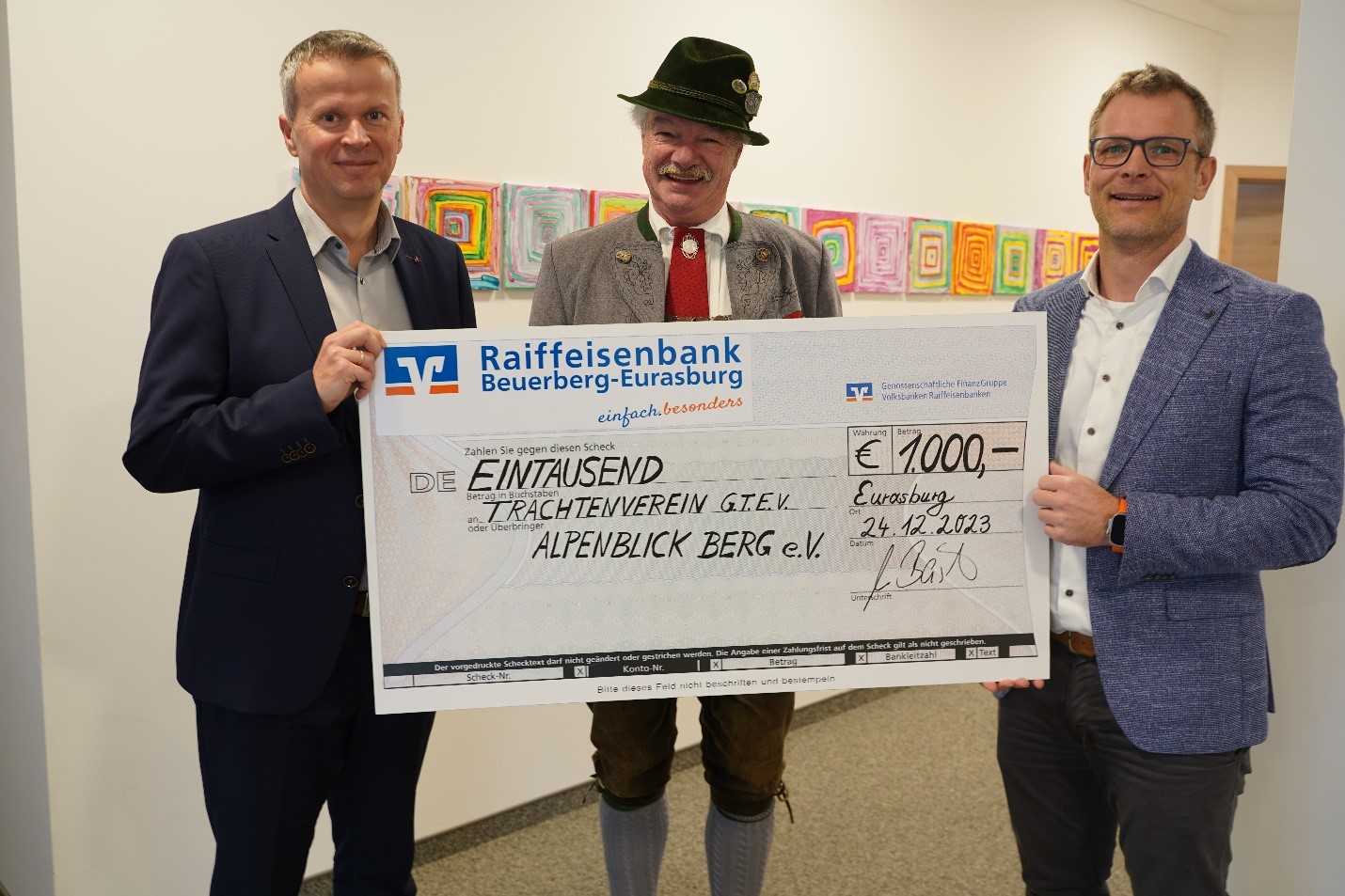

SPENDEN statt schenken Raiffeisenbank Beuerberg Eurasburg eG