Volksbank Dreiländereck: Your Guide To Easy & Secure Banking

Are you tired of complicated banking procedures that eat into your valuable time? Mobile banking and financial institutions that prioritize user-friendly solutions are revolutionizing the way we manage our money, offering unparalleled ease and security.

The digital age has transformed the financial landscape, making banking more accessible and convenient than ever before. Institutions like Volksbank Dreiländereck are at the forefront of this change, providing comprehensive online and mobile banking solutions tailored to meet the diverse needs of their customers. These services allow you to conduct your banking transactions anytime, anywhere, without the need to visit a physical branch. Imagine effortlessly managing your accounts, transferring funds, and paying bills from the comfort of your home or while on the go. The key is finding a banking partner that understands the importance of simplicity and security, ensuring that your financial activities are both efficient and protected.

| Category | Information |

|---|---|

| Name | Volksbank Dreiländereck |

| Type | Cooperative Bank |

| Services | Online Banking, Mobile Banking, Financial Products, Advisory Services |

| Focus | Regional Banking in the Dreiländereck Area |

| Website | Official Website |

One of the most significant advantages of modern banking is the accessibility it provides. No longer are you bound by the traditional banking hours or limited to conducting transactions at a physical branch. Online banking platforms offer 24/7 access to your accounts, allowing you to manage your finances whenever it suits you best. Whether you need to check your balance, transfer funds, or pay bills, you can do it all with just a few clicks or taps on your smartphone. This level of convenience is particularly beneficial for busy individuals who don't have the time to visit a bank during regular business hours.

- Uncover The Truth Unveiling The Marital Status Of Sara Jacobs

- Billy Crystals Twin Brother Unraveling The Family Mystery

Beyond basic transactions, online banking platforms also offer a range of additional features designed to streamline your financial management. For example, many banks now offer electronic statements, which not only reduce paper waste but also provide a convenient way to access your financial records. These statements are typically available online for several years, making it easy to track your spending and monitor your account activity. Furthermore, some banks offer tools to help you create budgets, set financial goals, and track your progress over time. These features can be invaluable in helping you take control of your finances and achieve your long-term financial objectives.

For business customers, online banking offers even more sophisticated tools and features designed to streamline their financial operations. These may include features such as bulk payment processing, automated reconciliation, and advanced reporting capabilities. By automating many of the manual tasks associated with managing finances, businesses can save time, reduce errors, and improve their overall efficiency. Furthermore, online banking platforms often offer enhanced security features, such as multi-factor authentication and fraud detection systems, to protect against unauthorized access and financial crime. This is particularly important for businesses that handle large volumes of transactions or sensitive financial data.

Volksbank Dreiländereck, for instance, understands the critical role that technology plays in modern banking and has invested heavily in developing a robust and user-friendly online banking platform. This platform offers a wide range of features designed to meet the needs of both individual and business customers. From basic transactions to more advanced financial management tools, the platform provides a comprehensive suite of services that make banking easier and more efficient.

- Stormi Websters Net Worth Unlocking Hidden Riches

- Uncovering The Inspiring Story Impact Of Deuce Tatums Mother

One of the key benefits of Volksbank Dreiländereck's online banking platform is its ease of use. The platform is designed with a user-friendly interface that makes it easy to navigate and find the information you need. Whether you're a seasoned online banking user or a complete novice, you'll find the platform intuitive and easy to understand. This is particularly important for older customers or those who are less familiar with technology. By making online banking accessible to everyone, Volksbank Dreiländereck is helping to bridge the digital divide and ensure that all its customers can benefit from the convenience and efficiency of modern banking.

In addition to its ease of use, Volksbank Dreiländereck's online banking platform also offers a high level of security. The platform uses advanced encryption technology to protect your personal and financial information from unauthorized access. Furthermore, the bank employs a range of fraud detection systems to monitor your account activity and identify any suspicious transactions. If any suspicious activity is detected, the bank will immediately contact you to verify the transaction and take steps to protect your account. This proactive approach to security helps to minimize the risk of fraud and ensures that your money is safe.

Mobile banking is another key component of the modern banking landscape. With the proliferation of smartphones and tablets, more and more people are using mobile devices to manage their finances. Mobile banking apps allow you to access your accounts, transfer funds, pay bills, and perform other banking transactions from anywhere in the world. This level of convenience is particularly appealing to younger customers who are always on the go and prefer to manage their finances from their mobile devices.

Mobile banking apps also offer a range of features that are not available through traditional online banking platforms. For example, many apps now offer mobile check deposit, which allows you to deposit checks simply by taking a picture of them with your smartphone. This eliminates the need to visit a bank branch or mail in your checks, saving you time and hassle. Furthermore, some apps offer location-based services that can help you find the nearest ATM or branch. These features make mobile banking an incredibly convenient and powerful tool for managing your finances.

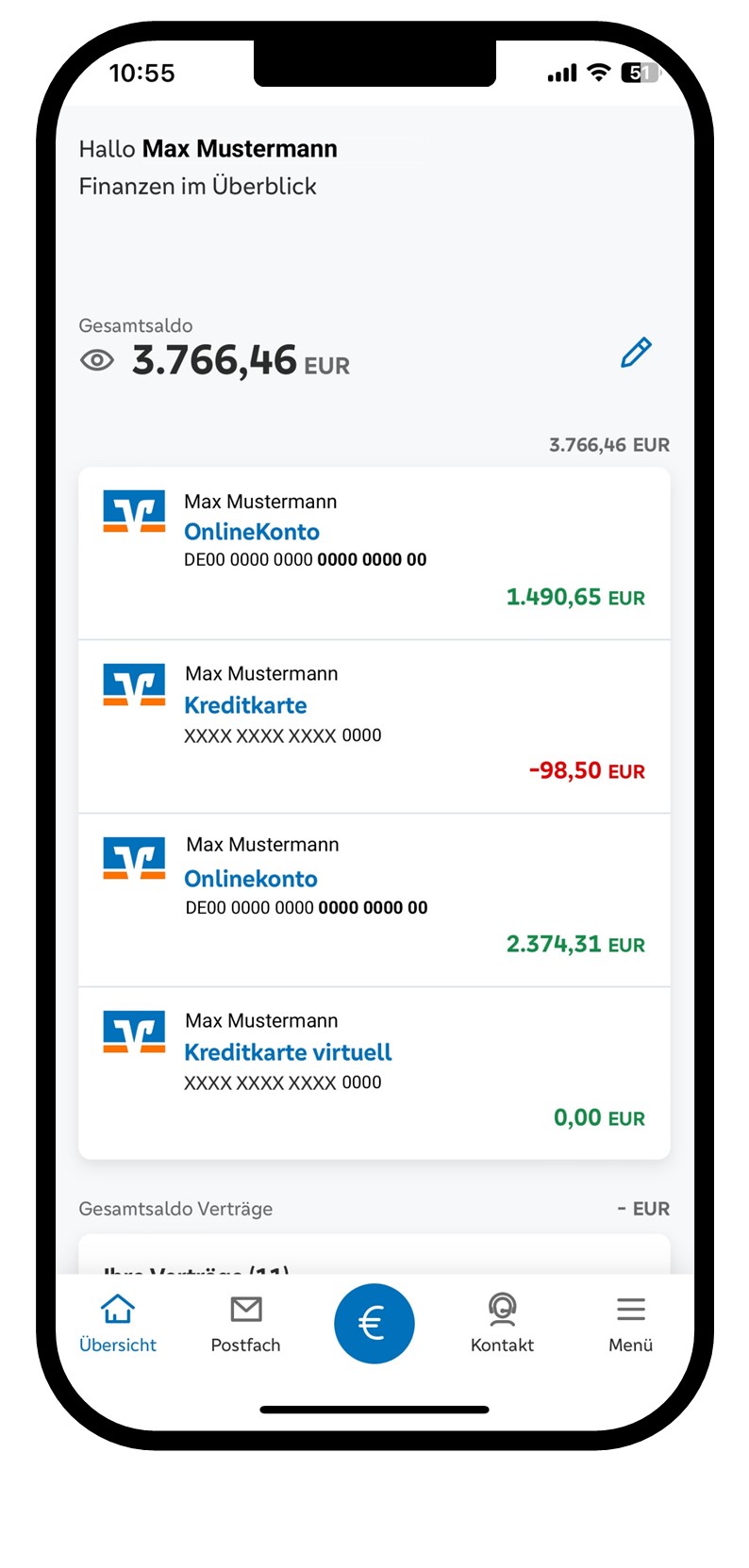

Volksbank Dreiländereck offers a comprehensive mobile banking app that is designed to meet the needs of its customers. The app is available for both iOS and Android devices and offers a wide range of features, including account management, fund transfers, bill payments, and mobile check deposit. The app is also highly secure, using advanced encryption technology to protect your personal and financial information.

In addition to online and mobile banking, modern banks also offer a range of other digital services designed to enhance the customer experience. These may include features such as online chat support, video banking, and personalized financial advice. Online chat support allows you to get quick answers to your questions without having to wait on hold on the phone. Video banking allows you to speak with a bank representative face-to-face from the comfort of your own home. And personalized financial advice can help you make informed decisions about your money and achieve your financial goals.

Volksbank Dreiländereck is committed to providing its customers with the best possible digital banking experience. The bank is constantly innovating and developing new digital services to meet the evolving needs of its customers. Whether you're looking for a convenient way to manage your accounts, expert financial advice, or the latest in digital banking technology, Volksbank Dreiländereck has you covered.

However, the transition to digital banking is not without its challenges. One of the biggest challenges is ensuring that all customers have access to the technology and skills they need to participate in the digital economy. This is particularly important for older customers or those who live in rural areas where internet access may be limited. Banks need to invest in education and outreach programs to help bridge the digital divide and ensure that all their customers can benefit from the convenience and efficiency of modern banking.

Another challenge is managing the risk of fraud and cybercrime. As more and more banking transactions move online, the risk of fraud and cybercrime increases. Banks need to invest in advanced security technologies and fraud detection systems to protect their customers' accounts and prevent financial crime. They also need to educate their customers about the risks of online fraud and provide them with the tools and resources they need to protect themselves.

Despite these challenges, the future of banking is undoubtedly digital. As technology continues to evolve, we can expect to see even more innovative digital banking services emerge. These services will make banking even more convenient, efficient, and secure. Banks that embrace digital transformation and invest in the latest technology will be best positioned to thrive in the years to come.

Volksbank Dreiländereck is committed to staying at the forefront of digital banking innovation. The bank is constantly exploring new technologies and developing new digital services to meet the evolving needs of its customers. By embracing digital transformation, Volksbank Dreiländereck is ensuring that it will continue to be a leading provider of financial services in the Dreiländereck region for many years to come.

The shift towards digital banking also necessitates a heightened focus on customer service. While technology offers convenience, it's crucial to maintain a human touch. Customers still value personalized support and the ability to speak with a knowledgeable representative when they have complex issues or require guidance. Banks that successfully integrate digital solutions with excellent customer service will create a superior banking experience.

This means providing multiple channels for communication, including phone support, email, and online chat. It also means empowering customer service representatives with the tools and training they need to resolve issues quickly and efficiently. Furthermore, banks should proactively seek feedback from customers to identify areas where they can improve their services and better meet their needs.

Volksbank Dreiländereck recognizes the importance of customer service and is committed to providing its customers with the best possible support. The bank has a team of dedicated customer service representatives who are available to answer questions and resolve issues by phone, email, and online chat. The bank also regularly seeks feedback from its customers to identify areas where it can improve its services.

The role of the physical branch is also evolving in the digital age. While online and mobile banking have reduced the need for in-person transactions, branches still play an important role in providing certain services, such as opening new accounts, applying for loans, and receiving financial advice. Branches also serve as a physical touchpoint for customers who prefer to interact with a bank representative in person.

As a result, banks are reimagining the role of the branch to make it more relevant and engaging for customers. This may involve redesigning branches to be more welcoming and comfortable, offering more personalized services, and hosting events and workshops to educate customers about financial topics. The goal is to create a branch experience that is both convenient and valuable for customers.

Volksbank Dreiländereck understands the importance of the physical branch and is committed to maintaining a strong branch network in the Dreiländereck region. The bank's branches are designed to be welcoming and comfortable, and they offer a wide range of services, including account opening, loan applications, and financial advice. The bank also hosts regular events and workshops to educate customers about financial topics.

Moreover, sustainability is becoming an increasingly important consideration for banks and their customers. Consumers are more aware of the environmental impact of their financial choices and are looking for banks that are committed to sustainability. This may involve reducing paper consumption, investing in renewable energy, and supporting sustainable businesses. Banks that prioritize sustainability are not only doing the right thing for the environment but also attracting and retaining customers who share their values.

Volksbank Dreiländereck is committed to sustainability and is taking steps to reduce its environmental impact. The bank has implemented a range of initiatives to reduce paper consumption, invest in renewable energy, and support sustainable businesses. The bank also encourages its customers to adopt sustainable practices, such as using electronic statements and paying bills online.

Ultimately, the future of banking is about providing customers with a seamless and personalized experience that meets their individual needs. This means offering a wide range of digital services, excellent customer service, and a commitment to sustainability. Banks that can successfully integrate these elements will be best positioned to thrive in the digital age and build long-term relationships with their customers.

Volksbank Dreiländereck is committed to providing its customers with the best possible banking experience. The bank is constantly innovating and developing new services to meet the evolving needs of its customers. Whether you're looking for a convenient way to manage your accounts, expert financial advice, or a commitment to sustainability, Volksbank Dreiländereck has you covered.

So, embrace the future of banking and discover the ease and security that modern financial institutions like Volksbank Dreiländereck offer. Take control of your finances and experience the convenience of banking anytime, anywhere.

We did not find results for:

Check spelling or type a new query.

We did not find results for:

Check spelling or type a new query.

Bankgeschäfte überall einfach und trotzdem sicher erledigen.

Mehr informationen bei ihrer volksbank dreiländereck.

Onlinebanking (firmenkunden) die es uns als volksbank dreiländereck eg erleichtern, ihnen eine optimale

Darüber hinaus bietet es viele weitere nützliche funktionen.

Profitieren sie beispielsweise vom elektronischen kontoauszug.

Cookies sind hilfreiche kleine informationsfragmente, die es uns als volksbank dreiländereck eg erleichtern, ihnen eine optimale bedienbare website anzubieten.

Weitere informationen dazu erhalten sie hier.

Viele kunden nutzen zur abwicklung ihrer finanzgeschäfte im internet entsprechende softwareprodukte.

Generell ist der abruf ihres elektronischen kontoauszugs über eine solche finanzsoftware möglich, sofern ihre software dies unterstützt.

Informieren sie sich bei ihrer volksbank dreiländereck.

Mehr dazu erfahren sie bei ihrer volksbank eg.

Sie sind immer optimal informiert mit den mobilen services ihrer volksbank dreiländereck.

Außerdem können sie verträgen zustimmen und diese per klick unterschreiben:

Volksbank dreiländereck weitergegeben • lastschriftmandate ihrer zahlungspflichtigen liegen ihnen im original vor • ihre zahlungspflichtigen wurden über den einzug schriftlich (mindestens 14 tage vor einzug) informiert.

Hier finden sie informationen zu beratung, ausstattung und öffnungszeiten.

Mehr informationen bei ihrer volksbank dreiländereck.

Wir freuen uns auf ihren besuch in der filiale hauptstraße 304.

Herzlich willkommen bei ihrer volksbank dreiländereck.

- Unveiling The Secrets Of John Leonards Net Worth A Journey Of Talent Success And Financial Prowess

- Uncovering The Extraordinary Legacy Of Dean Cains Mother

OnlineBanking erste Schritte Volksbank Backnang eG

OnlineBanking light Volksbank pur eG

Volksbank Pirna eG Neue VR Banking App Ihre Bank in der Sächsischen Schweiz